Financial Freedom: Unlock Your Potential with Smart Investments

Are you a millennial looking to secure your financial future and achieve true financial freedom? Look no further! With the right investment strategies, you can unlock your potential and set yourself up for long-term success. In this article, we will explore the top easy investment strategies for millennials that will help you grow your wealth and achieve your financial goals.

Investing in the stock market is a great way to grow your wealth over time. By investing in a diverse portfolio of stocks, you can take advantage of the long-term growth potential of the market. It’s important to do your research and choose stocks that align with your financial goals and risk tolerance. With the power of compound interest, your investments can grow exponentially over time, setting you up for financial success.

Real estate can be another lucrative investment opportunity for millennials looking to grow their wealth. By investing in rental properties or flipping houses, you can generate passive income and build equity over time. Real estate has a proven track record of long-term appreciation, making it a smart investment choice for those looking to secure their financial future.

Another easy investment strategy for millennials is to invest in low-cost index funds or exchange-traded funds (ETFs). These funds offer diversification and low fees, making them a great option for beginner investors. By investing in index funds, you can passively track the performance of the overall market and achieve steady, consistent returns over time.

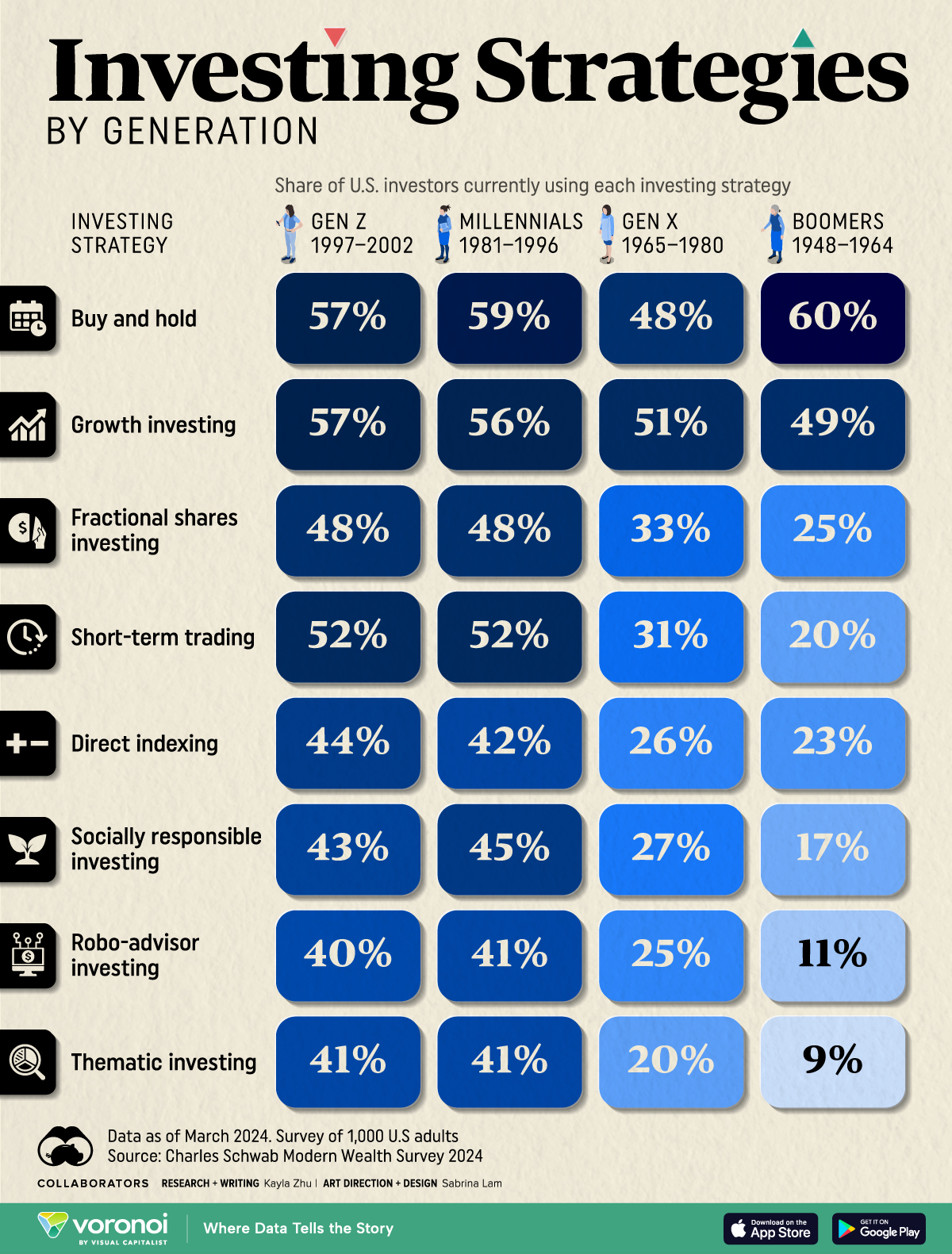

Image Source: visualcapitalist.com

Cryptocurrency has become a popular investment choice for millennials in recent years. While it can be a volatile and risky investment, the potential for high returns is enticing for many young investors. By doing your research and investing in established cryptocurrencies like Bitcoin and Ethereum, you can take advantage of this emerging asset class and potentially grow your wealth exponentially.

Peer-to-peer lending platforms offer another easy investment opportunity for millennials looking to grow their wealth. By lending money to individuals or small businesses through online platforms, you can earn competitive returns on your investment. Peer-to-peer lending allows you to diversify your investment portfolio and generate passive income, making it a great option for those looking to build wealth over time.

Investing in yourself can be one of the best investment strategies for millennials. By furthering your education, developing new skills, and pursuing career opportunities, you can increase your earning potential and set yourself up for long-term financial success. Whether it’s taking a course to enhance your skills or investing in a mentorship program, investing in yourself is a smart way to grow your wealth and achieve financial freedom.

Lastly, don’t forget about the power of retirement savings accounts like 401(k)s and IRAs. By contributing to these accounts early and consistently, you can take advantage of tax benefits and employer matching contributions. Retirement accounts offer a way to save for the future while also reducing your taxable income, making them a smart investment choice for millennials looking to secure their financial future.

In conclusion, mastering money and achieving financial freedom is possible for millennials with the right investment strategies. By investing in the stock market, real estate, index funds, cryptocurrency, peer-to-peer lending, yourself, and retirement accounts, you can unlock your potential and grow your wealth over time. Start investing today and take control of your financial future!

Millennials, Rejoice! 7 Simple Strategies to Grow Your Wealth

As a millennial, you may feel like the odds are stacked against you when it comes to building wealth. With student loan debt, rising housing costs, and a competitive job market, it can be overwhelming to think about investing your hard-earned money. However, there are simple strategies that can help you grow your wealth and secure your financial future. In this article, we will explore seven easy investment strategies that are perfect for millennials looking to master their money.

1. Start Early and Stay Consistent

One of the most important strategies for millennials looking to grow their wealth is to start investing early and stay consistent. The power of compound interest means that the earlier you start investing, the more time your money has to grow. By consistently investing a portion of your income, you can take advantage of market growth and maximize your returns over time.

2. Take Advantage of Employer-Sponsored Retirement Plans

Many millennials have access to employer-sponsored retirement plans, such as 401(k) or 403(b) accounts. These plans often come with employer matching contributions, which is essentially free money. By contributing to these retirement accounts, you can take advantage of tax benefits and grow your wealth over the long term. Be sure to contribute enough to receive the full employer match to maximize your savings potential.

3. Diversify Your Investments

Diversification is key to building a strong investment portfolio. By spreading your investments across different asset classes, industries, and geographic regions, you can reduce risk and improve your chances of success. Consider investing in a mix of stocks, bonds, real estate, and other assets to create a well-rounded portfolio that can weather market fluctuations.

4. Invest in Low-Cost Index Funds

For millennials who are just starting out, investing in low-cost index funds can be a smart strategy. These funds track a specific market index, such as the S&P 500, and offer broad diversification at a low cost. Index funds are a passive investment strategy that can help you achieve market returns over the long term without the need for active management.

5. Build an Emergency Fund

Before diving into more aggressive investment strategies, it’s important to build an emergency fund to cover unexpected expenses. Aim to save three to six months’ worth of living expenses in a high-yield savings account or money market fund. Having an emergency fund in place can provide peace of mind and prevent you from tapping into your investment accounts during times of financial hardship.

6. Educate Yourself and Seek Professional Advice

Investing can be complex, especially for beginners. Take the time to educate yourself on basic investment principles and strategies to make informed decisions about your money. Consider seeking advice from a financial advisor or planner who can help you develop a personalized investment plan based on your financial goals and risk tolerance.

7. Stay Disciplined and Avoid Emotional Investing

Finally, one of the most important strategies for millennials looking to grow their wealth is to stay disciplined and avoid emotional investing. Market volatility and media hype can tempt you to make impulsive decisions that can derail your long-term financial goals. Instead, stick to your investment plan, stay diversified, and focus on the big picture.

In conclusion, millennials have a unique opportunity to build wealth and secure their financial future by implementing simple investment strategies. By starting early, diversifying your portfolio, taking advantage of employer-sponsored retirement plans, and staying disciplined, you can grow your wealth over time. Remember to educate yourself, seek professional advice when needed, and remain patient in your investment journey. With these strategies in place, millennials can rejoice in the potential for financial success and achieve their money mastery goals.

Top 7 Investment Strategies for Millennials