Gaze into the Crystal Ball: Investment Trends for 2022!

As we ring in the new year, investors around the world are eagerly anticipating what the future holds in terms of investment trends for 2022. With the global economy slowly recovering from the impacts of the pandemic, there are several key areas that are expected to drive significant growth and offer lucrative investment opportunities in the upcoming year. Let’s take a closer look at some of the top investment trends that are predicted to shape the financial landscape in 2022.

One of the most prominent investment trends for 2022 is the rise of sustainable and ESG (Environmental, Social, and Governance) investing. With a growing awareness of climate change and social issues, more and more investors are looking to put their money into companies that prioritize sustainability and ethical practices. This trend is expected to continue gaining momentum in 2022, as consumers and shareholders alike demand greater transparency and accountability from corporations.

Another key trend to watch out for in 2022 is the continued growth of the technology sector. As digitalization and automation become increasingly important in our daily lives, companies that are at the forefront of technological innovation are expected to outperform the market. From artificial intelligence and blockchain to cybersecurity and e-commerce, there are plenty of opportunities for investors to capitalize on the tech boom in the coming year.

In addition to sustainable investing and technology, another trend that is expected to gain traction in 2022 is the rise of the fintech industry. With the increasing popularity of digital payments, online banking, and cryptocurrencies, fintech companies are poised for rapid growth in the year ahead. As traditional financial institutions face disruption from these up-and-coming players, investors are keeping a close eye on the fintech sector for potential high returns.

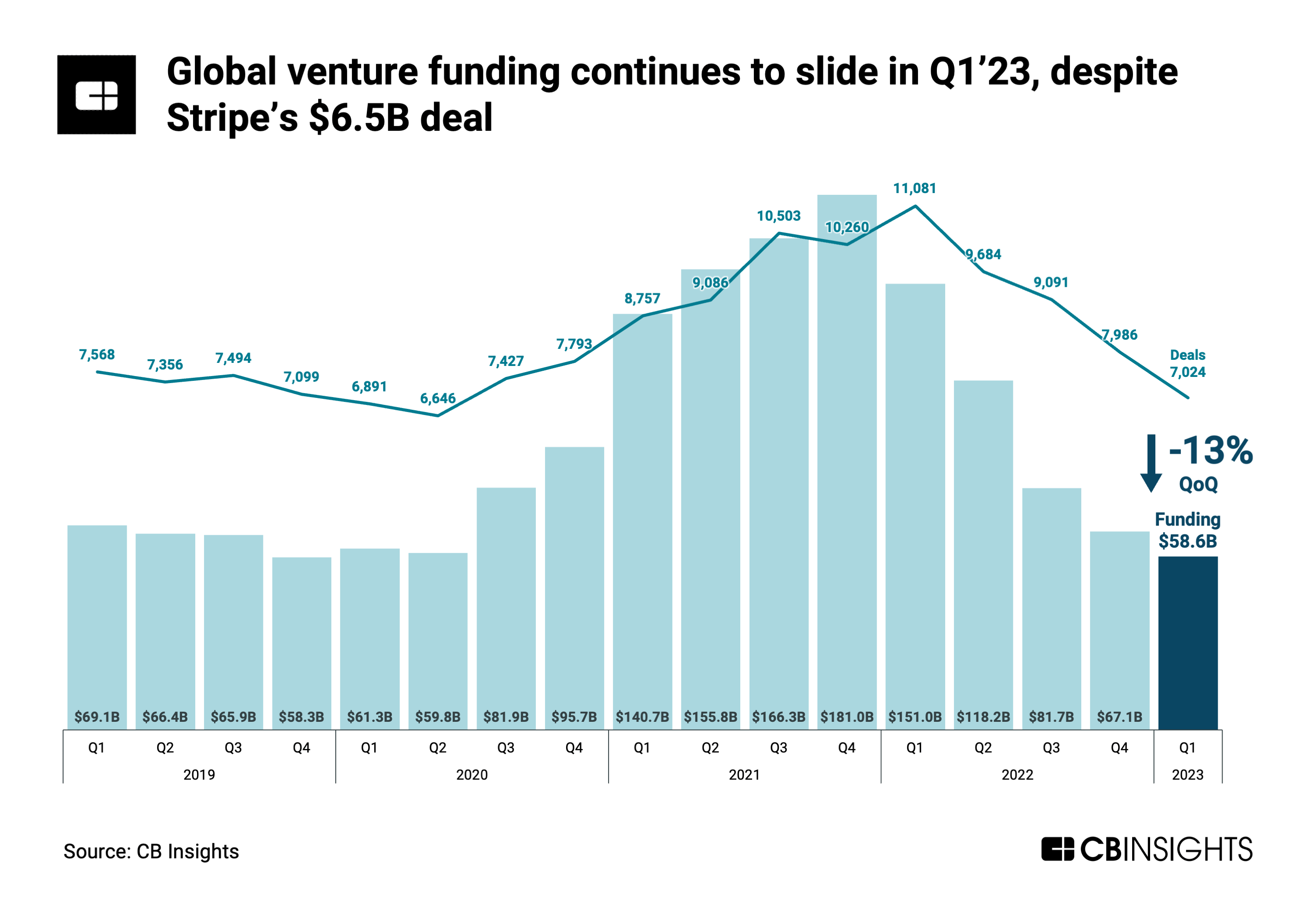

Image Source: cbinsights.com

Furthermore, the real estate market is also expected to be a hotbed for investment opportunities in 2022. As urbanization continues to drive demand for housing and commercial properties, investors are looking to capitalize on the growth of this sector. From residential real estate in booming cities to commercial properties in emerging markets, there are plenty of avenues for investors to explore in the real estate market in the coming year.

Lastly, the healthcare and biotech industries are also poised for significant growth and innovation in 2022. With the ongoing focus on healthcare and medical advancements, companies that are developing breakthrough treatments and technologies are expected to see strong returns. From pharmaceuticals and biotechnology to telemedicine and medical devices, the healthcare sector offers a diverse range of investment opportunities for savvy investors.

In conclusion, 2022 is shaping up to be an exciting year for investors, with a multitude of trends and opportunities on the horizon. From sustainable investing and technology to fintech, real estate, and healthcare, there are plenty of sectors that are expected to drive growth and offer lucrative returns in the upcoming year. By keeping a close eye on these top investment trends, investors can position themselves for success and capitalize on the ever-changing financial landscape.

Stay Ahead of the Curve: Top Investment Trends Unveiled!

As we approach the upcoming year, it’s essential for all investors to keep a close eye on the top investment trends that are set to shape the financial landscape. By staying ahead of the curve and being proactive in understanding these trends, investors can maximize their potential for success and growth in their investment portfolios. In this article, we will delve into the second item on our list of top investment trends to watch out for in the upcoming year.

One of the key trends that investors should be aware of is the rise of sustainable and ESG (Environmental, Social, and Governance) investing. In recent years, there has been a significant shift in investor preferences towards companies that are committed to sustainable practices and have a positive impact on society and the environment. This trend is only expected to continue growing in the upcoming year, as more and more investors prioritize ethical and socially responsible investments.

Companies that prioritize ESG factors are not only seen as more ethical and responsible, but they also tend to outperform their peers in the long run. By investing in companies that are aligned with sustainable practices, investors can not only feel good about where their money is going but also potentially see higher returns on their investments. As such, keeping a close eye on the ESG investing trend and incorporating it into your investment strategy could prove to be a wise decision in the upcoming year.

Another trend that investors should be mindful of is the increasing prominence of technology and innovation in the investment landscape. The rapid advancement of technology continues to disrupt traditional industries and create new opportunities for investment. From artificial intelligence and machine learning to blockchain and cryptocurrency, the possibilities for tech-driven investments are endless.

Investors who are able to identify and capitalize on these technological trends early on stand to benefit significantly. Whether it’s investing in companies that are at the forefront of innovation or exploring opportunities in emerging technologies, keeping abreast of the latest technological developments is crucial for staying ahead of the curve in the investment world.

In addition to sustainable investing and technological innovation, another trend that investors should keep an eye on is the growing importance of diversity and inclusion in the corporate world. Companies that prioritize diversity and create inclusive work environments tend to perform better and attract top talent. As such, investing in companies that value diversity and inclusion can be a smart move for investors looking to align their values with their investment decisions.

By incorporating diversity and inclusion considerations into their investment strategies, investors can not only support positive social change but also potentially see improved financial performance in their portfolios. As the importance of diversity and inclusion continues to gain traction in the corporate world, investors who are attuned to this trend will be well-positioned to capitalize on the opportunities it presents.

In conclusion, staying ahead of the curve and keeping a close watch on the top investment trends in the upcoming year is essential for all investors. By understanding and incorporating trends such as sustainable investing, technological innovation, and diversity and inclusion into their investment strategies, investors can position themselves for success and growth in their portfolios. As the financial landscape continues to evolve, being proactive and adaptable in response to these trends will be key to achieving long-term investment success.

Top Investment Trends to Watch in the Coming Year