Diversify Your Portfolio: The Key to Financial Success

Welcome to the world of investing! If you’re new to the game or looking to expand your portfolio, one of the most important concepts to understand is diversification. Diversifying your portfolio is like mixing up a delicious recipe with a variety of ingredients – it adds flavor, balance, and reduces risk. In this article, we will explore the importance of diversification and how you can use it to achieve financial success.

When it comes to investing, putting all your eggs in one basket is a risky move. If that one investment goes south, you could lose a significant portion of your portfolio. Diversification, on the other hand, spreads your investments across different assets, sectors, and markets, reducing the impact of any one investment underperforming. It’s a bit like having a safety net to catch you if one of your investments takes a tumble.

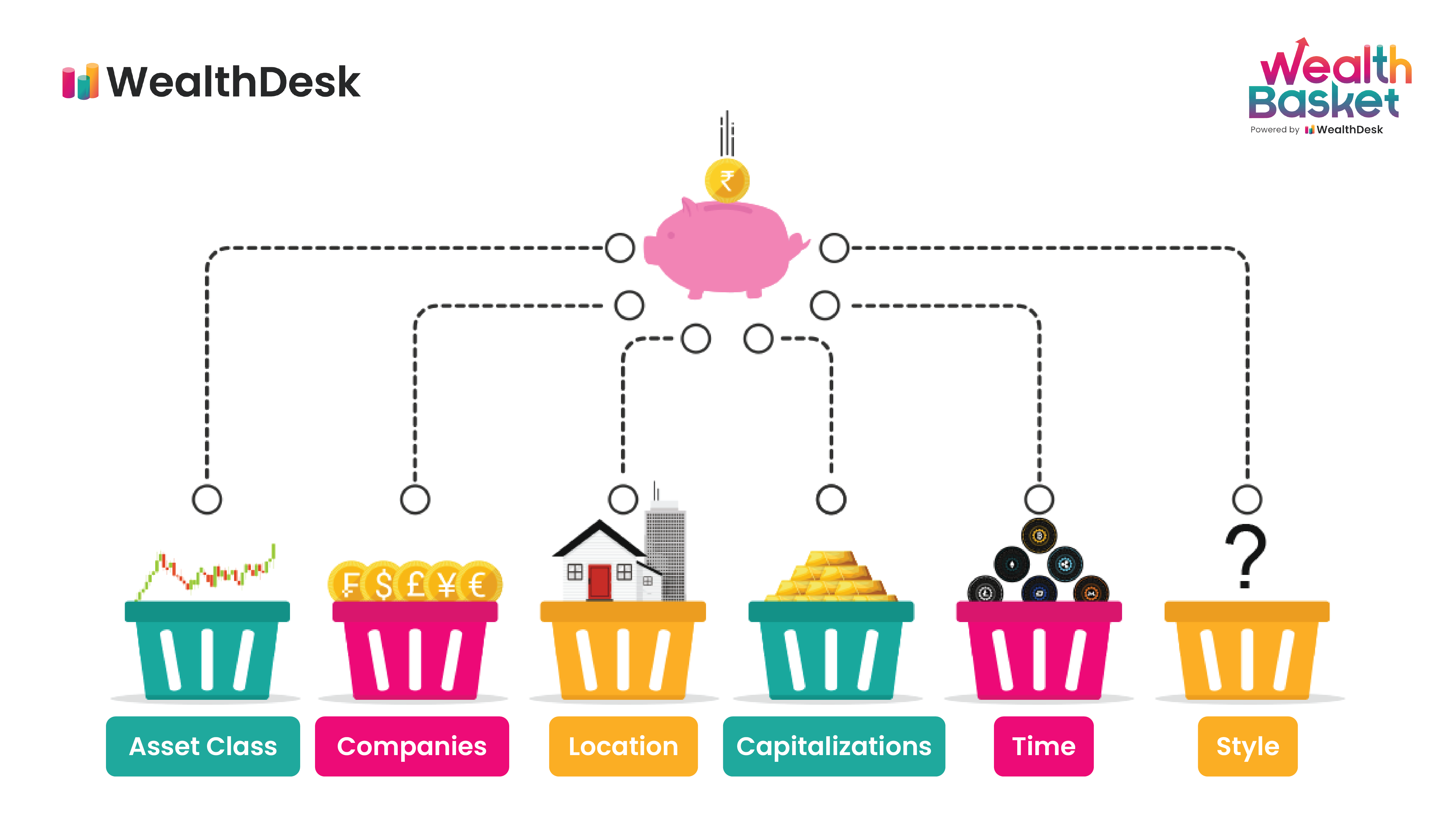

So, how can you diversify your portfolio? There are a few key strategies to keep in mind. First, consider investing in different asset classes. This could include stocks, bonds, real estate, commodities, and even alternative investments like cryptocurrencies or collectibles. Each asset class has its own risk and return profile, so by investing in a mix of them, you can lower your overall risk.

Another way to diversify is by investing in different sectors of the economy. For example, if you have a lot of tech stocks in your portfolio, consider adding some healthcare or energy stocks to balance things out. This way, if one sector experiences a downturn, you won’t be hit as hard.

Image Source: wealthdesk.in

Geographic diversification is also important. Investing solely in your home country’s stock market leaves you vulnerable to local economic downturns. By investing in international markets, you can spread your risk across different economies and currencies.

But diversification isn’t just about spreading your money around. It’s also about investing in assets with different correlations. Correlation measures how closely two investments move in relation to each other. By investing in assets with low or negative correlations, you can further reduce your portfolio’s overall risk.

For example, stocks and bonds often have a negative correlation – when stocks are down, bonds tend to perform well and vice versa. By holding both in your portfolio, you can smooth out the ups and downs of the market and potentially increase your returns over the long term.

Of course, diversification isn’t a one-and-done deal. It’s important to regularly review and rebalance your portfolio to ensure it stays diversified. This means selling off assets that have become too large a portion of your portfolio and reinvesting in areas that may be underrepresented.

Remember, diversification is not a guarantee against losses, but it can help you manage risk and improve your chances of long-term financial success. So, mix it up, spread your investments around, and watch your portfolio grow!

Unlocking the Secrets of Investing in Different Assets

When it comes to building a strong investment portfolio, diversification is key. This means spreading your investments across a range of different assets to help minimize risk and maximize returns. While stocks and bonds are commonly known investment options, there are a plethora of other assets that you can consider adding to your investment mix.

One such asset is real estate. Investing in real estate can provide a steady stream of passive income through rental properties or the potential for significant profits through property appreciation. Real estate can also act as a hedge against inflation, as property values tend to increase over time. Whether you choose to invest in residential properties, commercial properties, or real estate investment trusts (REITs), adding real estate to your investment portfolio can help diversify and strengthen your overall financial position.

Another asset class to consider is commodities. Commodities are raw materials or primary agricultural products that are bought and sold on exchanges. Investing in commodities can provide a hedge against inflation and currency fluctuations, as their values tend to rise when traditional investments like stocks and bonds are underperforming. Gold, silver, oil, and agricultural products are all examples of commodities that you can add to your investment portfolio.

Cryptocurrencies have also gained popularity as an alternative investment option in recent years. While cryptocurrencies like Bitcoin and Ethereum can be highly volatile, they have the potential for significant returns. Investing in cryptocurrencies can add a level of excitement and innovation to your investment portfolio, as well as diversify your holdings beyond traditional assets.

For those looking to invest in alternative assets, consider adding art or collectibles to your portfolio. Fine art, vintage cars, rare coins, and other collectibles can appreciate in value over time and provide a unique investment opportunity. Investing in art and collectibles can also be a way to express your personal interests and passions while diversifying your investment holdings.

Peer-to-peer lending platforms have also emerged as a popular way to invest in different assets. By lending money to individuals or small businesses through online platforms, investors can earn attractive returns while helping others access much-needed funds. Peer-to-peer lending can provide diversification to your investment portfolio and generate passive income streams outside of traditional investment options.

In addition to these alternative assets, consider investing in foreign currencies or international stocks to further diversify your portfolio. Investing in foreign currencies can help protect against currency fluctuations and provide exposure to different economies and markets around the world. International stocks can offer growth opportunities that may not be available in domestic markets, as well as additional diversification benefits.

Overall, the key to successful investing in different assets is to carefully consider your risk tolerance, investment goals, and time horizon before making any investment decisions. By mixing up your investment portfolio with a variety of assets, you can help protect against market volatility and potentially increase your overall returns. Remember to always do your research and consult with a financial advisor before making any investment decisions to ensure that your portfolio is well-balanced and aligned with your financial goals.

Diversifying Your Portfolio: How to Invest in Different Assets