Navigating the World of Index Funds: A Beginner’s Guide

Are you a beginner investor looking for a simple and effective way to grow your wealth? Index funds might just be the perfect investment vehicle for you. In this beginner’s guide, we will explore the benefits and drawbacks of index funds in your investment approach.

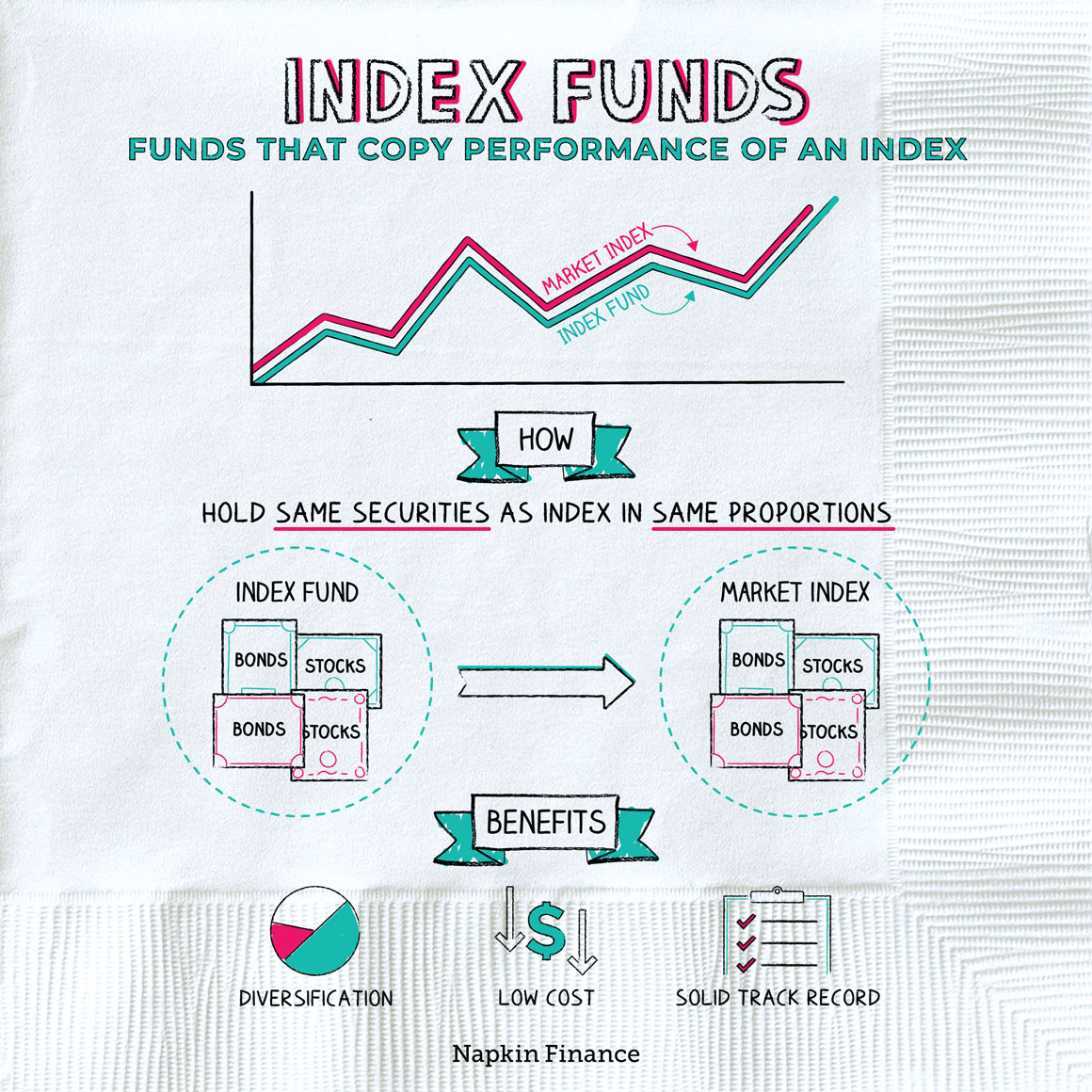

Index funds are a type of mutual fund or exchange-traded fund (ETF) that is designed to track a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. Instead of trying to beat the market by picking individual stocks, index funds aim to replicate the performance of the overall market. This passive investment strategy has gained popularity in recent years due to its simplicity and low costs.

One of the key benefits of investing in index funds is diversification. By investing in a single index fund, you are effectively investing in a broad range of stocks across different sectors and industries. This diversification helps to spread risk and reduce the impact of any one stock underperforming. For beginner investors who may not have the time or expertise to research individual stocks, index funds provide a simple way to achieve a well-diversified portfolio.

Another advantage of index funds is their low costs. Because index funds are passively managed and simply aim to replicate the performance of a market index, they typically have lower fees than actively managed funds. These lower fees can have a significant impact on your overall investment returns over time. By keeping costs low, index funds allow you to keep more of your investment gains for yourself.

Image Source: napkinfinance.com

In addition to diversification and low costs, index funds also offer transparency and simplicity. Since index funds are designed to track a specific market index, you always know what you are investing in. There are no surprises or hidden fees to worry about. This transparency can give you peace of mind knowing that your investments are in line with your financial goals.

Despite their many benefits, index funds do have some drawbacks that you should be aware of. One of the main drawbacks is that index funds are not actively managed. This means that if a particular stock in the index underperforms, the index fund will also underperform. While this passive approach can be beneficial in terms of lower costs and simplicity, it also means that you are not taking advantage of potential market opportunities.

Another drawback of index funds is that they are not designed to outperform the market. If you are looking to beat the market or achieve higher returns than the index, index funds may not be the best investment choice for you. However, for many investors, the goal is not to outperform the market but rather to achieve solid, consistent returns over the long term.

In conclusion, index funds can be a valuable addition to your investment portfolio, especially if you are a beginner investor looking for a simple and cost-effective way to grow your wealth. By understanding the benefits and drawbacks of index funds, you can make an informed decision about whether or not they are the right investment choice for you. So, dive into the world of index funds and start exploring the possibilities for your financial future!

Pros and Cons of Index Funds: What You Need to Know!

Have you ever considered investing in index funds but weren’t sure if they were the right choice for you? Index funds have become increasingly popular among investors due to their low costs and diversification benefits. However, like any investment, index funds come with their own set of pros and cons that you should be aware of before diving in. In this article, we will explore the benefits and drawbacks of index funds to help you make an informed decision for your investment approach.

Pros of Index Funds:

1. Diversification: One of the biggest advantages of index funds is their ability to provide instant diversification to your portfolio. By investing in an index fund, you are essentially buying a small piece of a large number of companies, which helps spread out your risk.

2. Low Costs: Index funds are known for their low expense ratios compared to actively managed funds. Because index funds simply aim to replicate the performance of a specific index, they require less day-to-day management, resulting in lower fees for investors.

3. Passive Management: Index funds are passively managed, meaning they do not require a team of analysts making frequent trades in an attempt to beat the market. This passive approach often results in lower turnover and tax efficiency for investors.

4. Performance Tracking: Index funds track the performance of a specific index, such as the S&P 500, allowing investors to easily compare their returns to the overall market. This transparency can help investors gauge the effectiveness of their investment strategy.

5. Accessibility: Index funds are easily accessible to individual investors through various brokerage platforms and retirement accounts. This accessibility makes it easy for investors of all experience levels to add index funds to their portfolios.

Cons of Index Funds:

1. Limited Growth Potential: While index funds provide diversification benefits, they may limit your potential for outsized returns compared to actively managed funds. Because index funds aim to match the performance of a specific index, they may not capture the full upside potential of individual stocks.

2. Lack of Customization: Index funds are designed to replicate the performance of a specific index, which means investors have little control over the individual companies included in the fund. This lack of customization may not align with the specific investment goals or values of some investors.

3. Market Weighting: Index funds are typically weighted based on the market capitalization of each stock within the index. This means that larger companies with higher market caps will have a greater impact on the fund’s performance, potentially leading to overexposure to certain sectors or industries.

4. Tracking Error: While index funds aim to closely track the performance of a specific index, there may be instances where the fund’s performance deviates slightly from the index due to factors such as fees, trading costs, or timing differences. This tracking error can impact investor returns over time.

5. Limited Active Management: While passive management is a key benefit of index funds, it may also be a drawback for investors seeking a more hands-on approach to their investments. Index funds do not allow for active decision-making or market timing, which may be a disadvantage for some investors.

In conclusion, index funds offer a range of benefits such as diversification, low costs, and passive management, making them an attractive option for many investors. However, it’s important to consider the drawbacks of index funds such as limited growth potential, lack of customization, and market weighting before making a decision. By weighing the pros and cons of index funds, you can determine if they align with your investment goals and risk tolerance.

The Pros and Cons of Index Funds in Your Investment Strategy