Skyrocket Your Wealth: Real Estate Crowdfunding Tips!

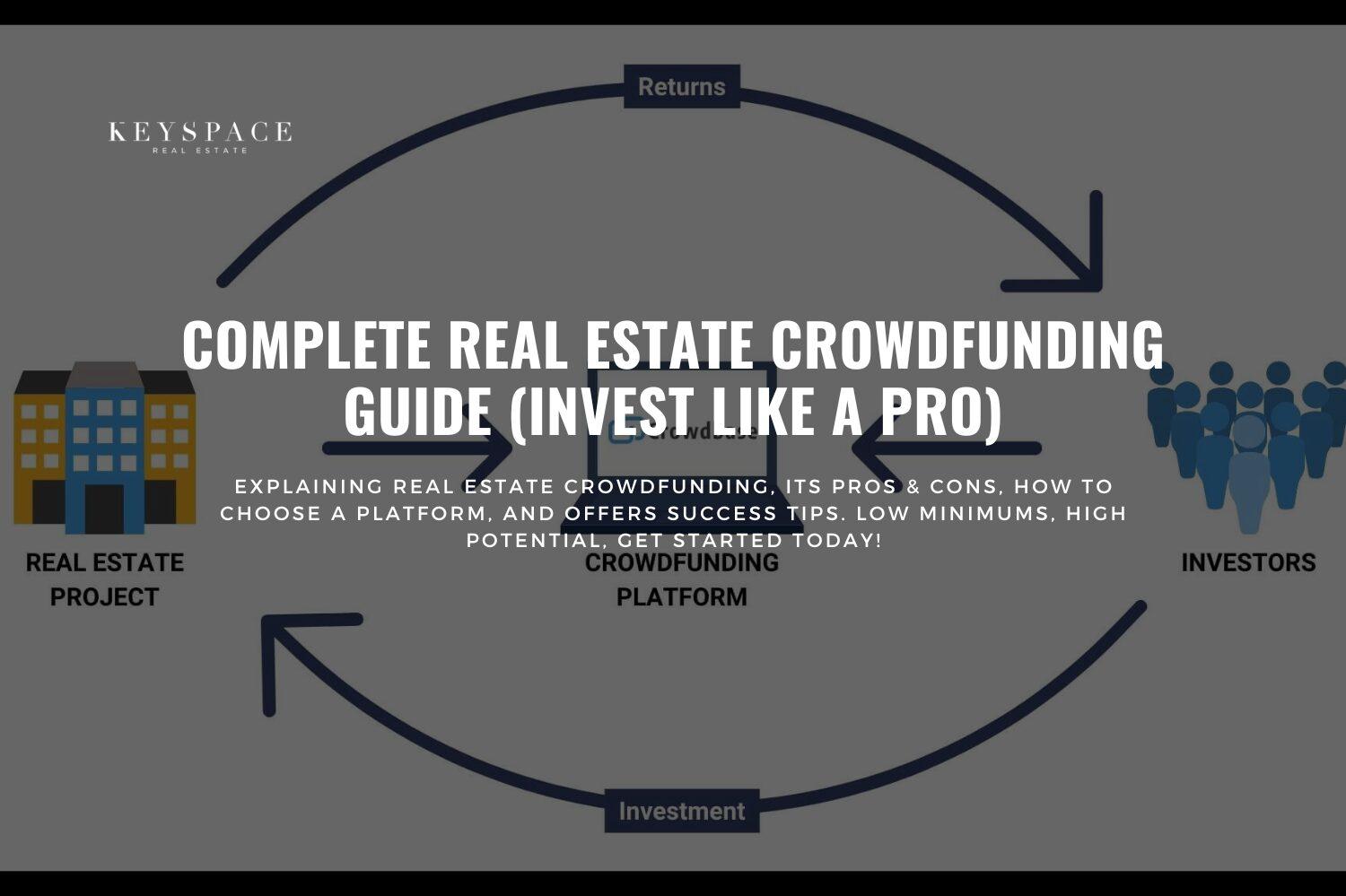

Are you looking to maximize your investment success and grow your wealth through real estate crowdfunding? If so, you’ve come to the right place! Real estate crowdfunding is a revolutionary way to invest in properties without the hassle of traditional real estate investing. By pooling your funds with other investors, you can access a variety of real estate projects and diversify your portfolio for maximum returns.

To help you navigate the world of real estate crowdfunding and make the most of your investments, we’ve compiled a list of tips that will skyrocket your wealth and set you on the path to financial success.

1. Do Your Research: Before diving into any real estate crowdfunding project, it’s essential to do your due diligence and research the platform, the property, and the sponsors involved. Look for platforms with a track record of successful projects and positive reviews from investors. Additionally, review the property details, location, and potential returns to ensure it aligns with your investment goals.

2. Diversify Your Portfolio: One of the key benefits of real estate crowdfunding is the ability to diversify your portfolio across multiple properties and projects. By spreading your investments across different asset classes, locations, and sponsors, you can mitigate risk and maximize returns. Consider investing in a mix of residential, commercial, and mixed-use properties to diversify your portfolio and increase your chances of success.

Image Source: keyspacerealty.com

3. Set Clear Investment Goals: Before making any investment decisions, take the time to define your investment goals and risk tolerance. Are you looking for short-term returns or long-term appreciation? Are you comfortable with higher-risk investments for the potential of higher returns? By setting clear goals and understanding your risk tolerance, you can make informed investment decisions that align with your financial objectives.

4. Stay Informed: The world of real estate crowdfunding is constantly evolving, with new platforms, projects, and regulations emerging regularly. To stay ahead of the curve and maximize your investment success, stay informed about industry trends, market conditions, and new opportunities. Join online forums, attend webinars, and network with other investors to learn from their experiences and stay up to date on the latest developments in the real estate crowdfunding space.

5. Monitor Your Investments: Once you’ve made your investments, it’s essential to monitor their performance regularly and make adjustments as needed. Keep track of key metrics such as occupancy rates, rental income, and property appreciation to assess the health of your investments. If a project is underperforming or not meeting your expectations, don’t be afraid to cut your losses and reallocate your funds to more promising opportunities.

6. Reinvest Your Returns: As your real estate crowdfunding investments start to generate returns, resist the temptation to cash out immediately. Instead, consider reinvesting your profits into new projects to accelerate your wealth-building efforts. By reinvesting your returns, you can take advantage of compounding returns and grow your portfolio exponentially over time.

By following these real estate crowdfunding tips, you can skyrocket your wealth and achieve investment success in the competitive world of real estate crowdfunding. Remember to do your research, diversify your portfolio, set clear investment goals, stay informed, monitor your investments, and reinvest your returns to maximize your investment success and achieve your financial goals. Happy investing!

Unlock the Secrets to Investment Success Today!

Are you ready to take your investment game to the next level? Do you want to unlock the secrets to maximizing your success in the world of real estate crowdfunding? If so, you’ve come to the right place! In this article, we will delve into the key strategies and tips that can help you achieve your investment goals and secure your financial future.

Real estate crowdfunding has become an increasingly popular way for investors to diversify their portfolios and generate passive income. By pooling funds with other investors, you can access a wide range of real estate opportunities that may have been out of reach otherwise. However, success in real estate crowdfunding requires more than just throwing money at a project and hoping for the best. It requires careful planning, research, and a strategic approach.

One of the first steps to unlocking investment success is to set clear and achievable goals. Whether you’re looking to generate a steady stream of passive income, build equity in properties, or simply diversify your investment portfolio, having a clear goal in mind will help you stay focused and motivated. Take the time to assess your financial situation, risk tolerance, and investment timeline to determine what type of real estate crowdfunding opportunities align with your objectives.

Once you have a clear goal in mind, the next step is to conduct thorough research on potential investment opportunities. Look for platforms that have a track record of success, transparent fees, and a diverse range of projects to choose from. Consider the location, type of property, and projected returns of each investment opportunity to determine if it aligns with your goals and risk tolerance. Don’t be afraid to ask questions and seek advice from experienced investors or financial advisors to help you make informed decisions.

In addition to conducting thorough research, it’s also important to diversify your investment portfolio to minimize risk and maximize returns. Instead of putting all your eggs in one basket, consider spreading your investments across multiple real estate crowdfunding projects. This will help protect your investment from potential fluctuations in the market and increase your chances of generating a consistent return over time.

Another key to unlocking investment success is to stay informed and up-to-date on market trends, regulations, and best practices in real estate crowdfunding. Join online forums, attend webinars, and read industry publications to stay ahead of the curve and make informed decisions about your investments. By staying informed, you can identify emerging opportunities, anticipate market changes, and adapt your investment strategy accordingly.

Finally, don’t underestimate the power of networking and building relationships with other investors in the real estate crowdfunding space. By connecting with like-minded individuals, you can share insights, learn from each other’s experiences, and potentially collaborate on future investment opportunities. Networking can also open doors to new investment opportunities, partnerships, and resources that can help you achieve your investment goals faster and more effectively.

In conclusion, unlocking the secrets to investment success in real estate crowdfunding requires a combination of careful planning, research, diversification, and staying informed. By setting clear goals, conducting thorough research, diversifying your portfolio, staying informed on market trends, and networking with other investors, you can maximize your chances of success and achieve your investment goals. So, what are you waiting for? Start unlocking your investment success today!

How to Leverage Real Estate Crowdfunding for Investment Success