Beating the Clock: 5 Investment Strategies

In today’s fast-paced world, it’s more important than ever to stay ahead of inflation and make sure your investments are keeping pace. With so many options available, it can be overwhelming to know where to start. That’s why we’ve put together a list of five winning investment strategies to help you outpace inflation and make the most of your money.

1. Diversify Your Portfolio

One of the most important strategies for beating inflation is to diversify your portfolio. By spreading your investments across a range of different asset classes, you can reduce your risk and increase your chances of earning a solid return. This means investing in a mix of stocks, bonds, real estate, and other assets that have historically performed well over time.

2. Invest in High-Quality Stocks

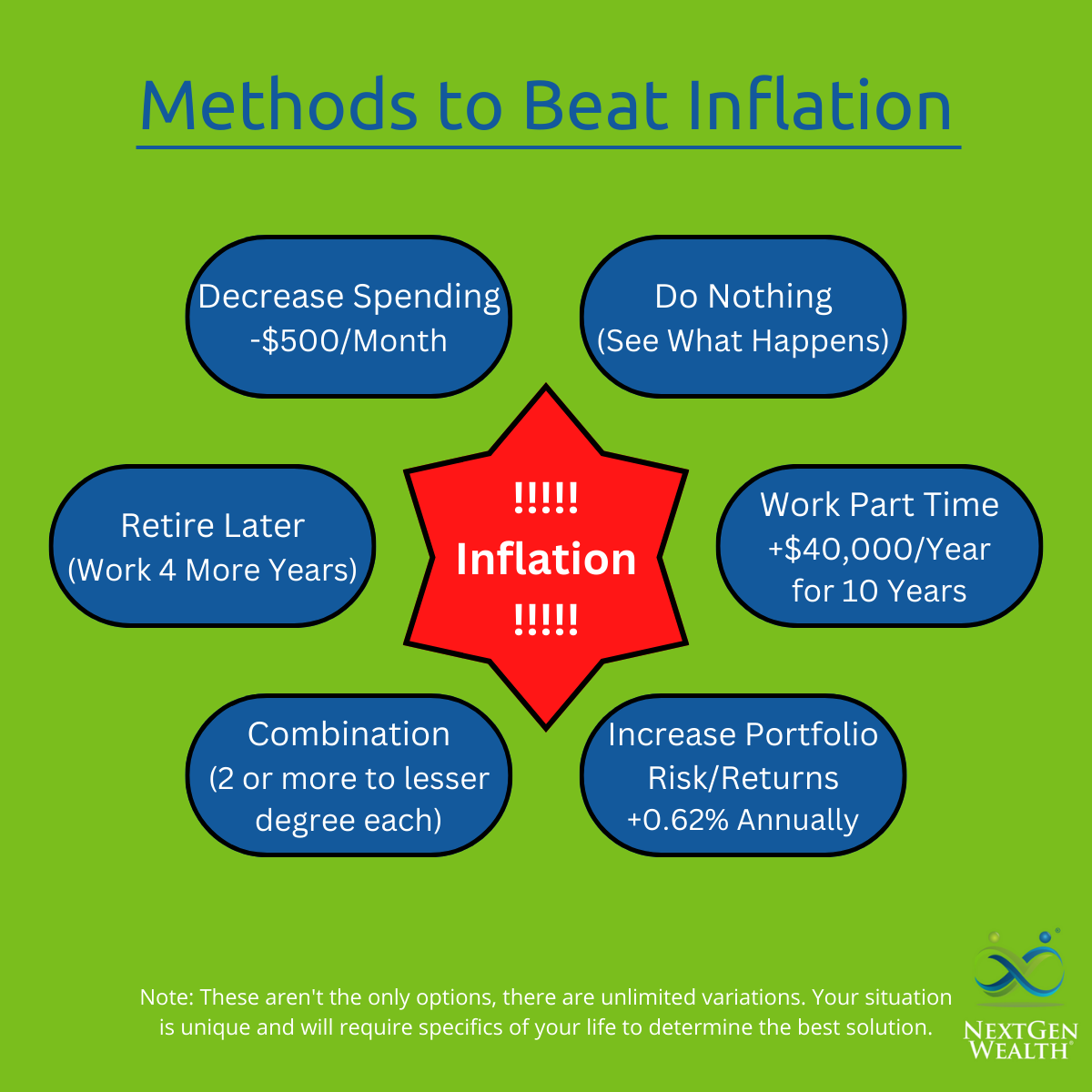

Image Source: nextgen-wealth.com

Another key strategy for outpacing inflation is to invest in high-quality stocks. Look for companies with strong fundamentals, solid earnings growth, and a history of increasing dividends. These types of stocks tend to perform well over the long term and can help protect your portfolio against inflation.

3. Consider Real Estate Investments

Real estate can be a great way to hedge against inflation and generate passive income. Whether you invest in rental properties, commercial real estate, or real estate investment trusts (REITs), real estate can provide a stable source of income and potential for capital appreciation over time.

4. Invest in Precious Metals

Precious metals like gold and silver have long been considered a safe haven investment during times of economic uncertainty. These metals have a history of preserving wealth and can help protect your portfolio against inflation. Consider adding some precious metals to your investment portfolio to help safeguard your wealth.

5. Stay Active and Keep Learning

Finally, one of the most important investment strategies for beating inflation is to stay active and keep learning. The financial markets are constantly evolving, and it’s important to stay informed about new investment opportunities, market trends, and economic developments. By staying proactive and continuously educating yourself, you can make informed decisions about your investments and stay ahead of inflation.

In conclusion, beating the clock and outpacing inflation requires a strategic approach to investing. By diversifying your portfolio, investing in high-quality stocks, considering real estate investments, adding precious metals to your portfolio, and staying active and informed, you can set yourself up for success and ensure that your investments keep pace with inflation. Remember, the key to successful investing is to stay disciplined, stay focused, and always be willing to adapt to changing market conditions. With these winning investment strategies in your toolkit, you’ll be well on your way to achieving your financial goals and securing your financial future.

Stay Ahead of Inflation with these Tips

In today’s ever-changing economic landscape, it is crucial for investors to stay ahead of inflation in order to protect and grow their wealth. Inflation erodes the purchasing power of money over time, making it essential for investors to implement strategies that outpace the rising cost of goods and services. Here are some tips to help you stay ahead of inflation and secure a prosperous financial future.

One winning investment strategy to outpace inflation is to invest in assets that have a history of providing returns that outpace inflation over the long term. This includes investing in stocks, real estate, and commodities such as gold. Stocks, in particular, have historically provided returns that exceed the rate of inflation, making them a solid investment choice for those looking to grow their wealth over time.

Another effective way to outpace inflation is to diversify your investment portfolio. By spreading your investments across different asset classes, you can reduce the impact of inflation on your overall portfolio performance. Diversification can help protect your investments from the negative effects of inflation while also providing opportunities for growth in various market conditions.

Additionally, investing in bonds that offer a return higher than the inflation rate can help you stay ahead of rising prices. Treasury inflation-protected securities (TIPS) are a type of bond that is specifically designed to provide investors with protection against inflation. By investing in TIPS, you can ensure that your returns keep pace with inflation, preserving the purchasing power of your money over time.

Another strategy to outpace inflation is to regularly review and adjust your investment portfolio to account for changing market conditions. By staying informed about economic trends and adjusting your investments accordingly, you can position yourself to take advantage of opportunities that arise in the market. This proactive approach can help you stay ahead of inflation and maximize your investment returns over time.

Lastly, investing in assets that have the potential for capital appreciation can help you outpace inflation and grow your wealth over time. By investing in assets that have the potential to increase in value, such as growth stocks or real estate in high-demand markets, you can generate returns that exceed the rate of inflation. This can help you build wealth and achieve your financial goals despite the challenges posed by inflation.

In conclusion, staying ahead of inflation is essential for investors looking to protect and grow their wealth over time. By implementing these winning investment strategies, you can outpace inflation and secure a prosperous financial future. Whether you choose to invest in stocks, real estate, bonds, or other assets, it is important to diversify your portfolio, stay informed about market trends, and seek out opportunities for capital appreciation. By following these tips, you can stay ahead of inflation and achieve your financial goals in the long run.

5 Investment Strategies That Beat Inflation